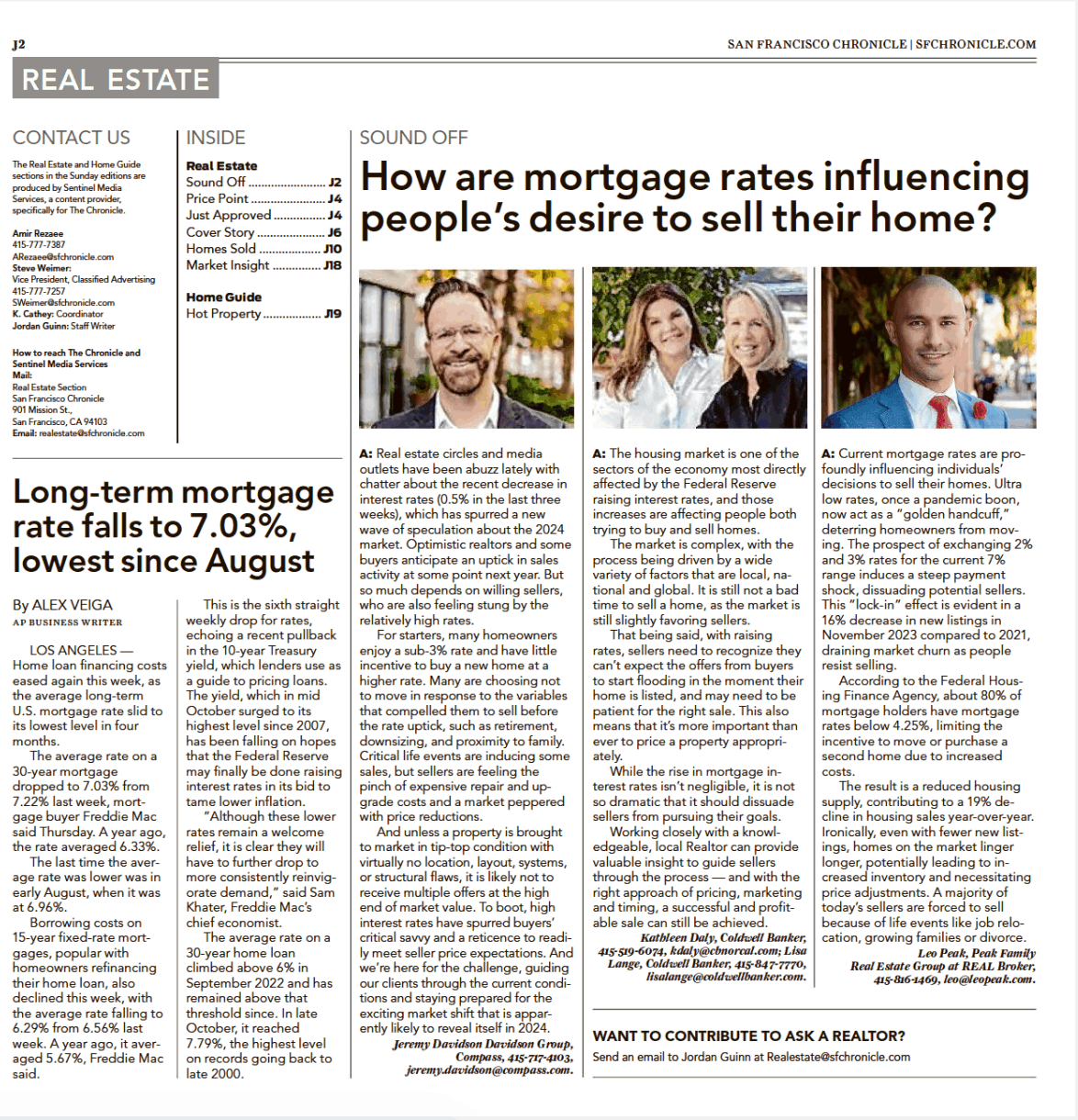

How are mortgage rates influencing people’s desire to sell their home?

A: Current mortgage rates are profoundly influencing individuals’ decisions to sell their homes. Ultra low rates, once a pandemic boon, now act as a “golden handcuff,” deterring homeowners from moving. The prospect of exchanging 2% and 3% rates for the current 7% range induces a steep payment shock, dissuading potential sellers. This “lock-in” effect is evident in a 16% decrease in new listings in November 2023 compared to 2021, draining market churn as people resist selling.

A: Current mortgage rates are profoundly influencing individuals’ decisions to sell their homes. Ultra low rates, once a pandemic boon, now act as a “golden handcuff,” deterring homeowners from moving. The prospect of exchanging 2% and 3% rates for the current 7% range induces a steep payment shock, dissuading potential sellers. This “lock-in” effect is evident in a 16% decrease in new listings in November 2023 compared to 2021, draining market churn as people resist selling.

According to the Federal Housing Finance Agency, about 80% of mortgage holders have mortgage rates below 4.25%, limiting the incentive to move or purchase a second home due to increased costs.

The result is a reduced housing supply, contributing to a 19% decline in housing sales year-over-year. Ironically, even with fewer new listings, homes on the market linger longer, potentially leading to increased inventory and necessitating price adjustments. A majority of today’s sellers are forced to sell because of life events like job relocation, growing families or divorce.

---

Original article published in the San Francisco Chronicle on December 11, 2023

Recent Posts